Happy 155th birthday, Canada! As the world continues to be out of balance and the financial markets test our resolve, perhaps this is an opportune time to step away from the headlines and focus on the many reasons to be grateful to be in Canada.

We are a nation of peace, prosperity and resilience, considered to have a stable economy and a strong quality of life. Despite our small stature by population — Canada represents just 0.48 percent of the total world’s population — we rank as the 10th largest economy by GDP (2021). We have one of the highest life expectancies, in part due to our universal healthcare system. And, we consistently rank as one of the best countries in which to live globally, when measured by quality of life, freedom, education and health.

We are relatively insulated from many of the current challenges that face other nations. The ongoing war in the Ukraine should be a reminder that even basic necessities like food, shelter, health and safety are luxuries to those in need. With energy production again in the spotlight as a matter of national security, we are fortunate to have access to all major sources of energy. Beyond energy, we are a nation rich in resources, including uranium, zinc, potash, nickel and titanium. Notably, we are ranked fourth in the world for countries rich in natural resources, behind Russia, the U.S., and Saudi Arabia. We are also the fifth largest exporter of agricultural and food products in the world.

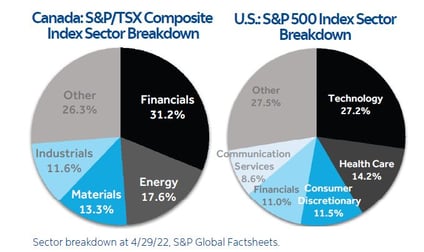

For investors, the Canadian equity market composition may be well- positioned to face the challenges of today. It may be comparatively more tolerant to inflationary environments, due to its greater exposure to financials, resources, materials and industrials sectors. At the time of writing, while markets have experienced broad-based declines, the S&P/TSX Composite Index has performed better than its U.S. counterpart. Regardless, as history has shown, investors should remember that over the long term, equity market returns have generally outperformed inflation and continued their upward climb.

This is also why diversification is important. No sector — or even asset class or geographical market — will perform at the top each year. Diversification can provide the opportunity to participate in the upside of the best performers each year.

While there has been a lot of talk about economic growth being hindered by tightening monetary policy, there may be factors to support our resilience. Canada’s expansion is expected to outpace the growth of other advanced economies this year, in part because the impact of the European crisis will be tempered by our commodities sector. This may be reflected in our economic performance to start the year: Q1 2022 GDP grew at a rate of 3.1 percent in Canada, whereas it contracted in the U.S. Also supportive for growth — our labour market continues to be strong and our population continues to grow at a faster rate than our peers; the fastest of the Group of Seven (G7) advanced countries, at 5.2 percent over the past five years.5

Without a doubt, there are many challenges ahead; however, there are many reasons to keep perspective. We hope that you can take some time to enjoy the summer and celebrate living in our wonderful nation!